first time home buyer stamp duty exemption malaysia 2018

They are Albania Bosnia and Herzegovina Kosovo Macedoni Montenegro. China spans five geographical time zones and borders fourteen countries by land the most of any country in the world tied with RussiaChina also has a narrow maritime boundary with the disputed Taiwan.

Malaysia What Is Home Ownership Campaign Hoc And How You Can Benefit From It

For first-home buyers purchasing a home valued between 650001 and 850000 a concessional rate of stamp duty applies.

. Get 247 customer support help when you place a homework help service order with us. Stamp duties are also levied on certain court procedures eg. Singapores economy has been previously ranked as the most open in the world the joint 4th-least corrupt and the most pro-business.

Earlier tax was deducted on the money paid by the buyer to the seller. If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans please check the following box. If youre a first home owner in Victoria you wont have to pay any stamp duty if your property is valued at less than 600000 and you entered into your contract after 1 July 2017.

The liability to SDRT may be cancelled by paying the stamp duty due on a stock transfer form or other transfer instrument executed in pursuance of the agreement. Therefore when calculating the stamp duty fee you need to deduct RM2400 from the annual rental amount to determine the taxable rental. Residential properties transferred into trusts for housing developers will continue to be subject.

Stamp duty is for instance levied in an amount of. Gun laws and policies collectively referred to as firearms regulation or gun control regulate the manufacture sale transfer possession modification and use of small arms by civilians. Appeals to the tax authority.

Stamp duty is paid by a buyer in most cases. China officially the Peoples Republic of China PRC is a country in East AsiaIt is the worlds most populous country with a population exceeding 14 billion people. As part of the governments COVID-19 support measures this threshold was temporarily increased for the purchase of new homes valued between 800000 and 1 million and vacant land valued between 400000 and 500000.

A trust that is created by a person during his or her lifetime with effect from 9 May 2022This will be known as ABSD Trust. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. Stamp duty rates differ in various states across the country as stamp duty in India is a state subject. The increment comes after the government announced a stamp duty exemption for first time home buyer of properties below RM500000 in July with the aim of encouraging ownership of first residential property.

However the Central Government fixes the stamp duty rates of specific instruments. Must contain at least 4 different symbols. Singapore has low tax-rates and the second-highest per-capita GDP in the world in terms of purchasing power parity PPP.

Politics-Govt Just in time for US. The Taxation trend in Western Balkans 2016 publication is first edition of publication of tax policies and issues in the Western Balkans countries. All our clients personal information is stored safely.

Stamp duty taxes. Agreements to sell shares usually attract stamp duty reserve tax SDRT at 05. HUF 100000 on the registration of a private stock company.

We have encrypted all our databases. Stamp duty taxes Imposta di Bollo apply on a certain list of deeds or documents provided for by the relevant law provision eg. The countries that compile the contents of this report are part of Western Balkans and are ranked based in alphabetic order.

However according to Stamp Duty Remission Order 2003 all contract notes relating to the sale of any shares stock or marketable securities listed on a stock exchange approved under subsection 82 of the Securities Industry Act 1983 are waived from stamp duty exceeding MYR200 calculated at the prescribed rate in item 31 of the First Schedule. From time to time after this registration statement becomes effective. Senior citizens aged 75 years and above exempted from fling ITR.

Senate race border wall gets a makeover. However both the seller and the buyer have to bear the burden of stamp duty for property exchange cases. Its worth noting that this is a separate scheme from the First Home Owner Grant FHOG which is a lump-sum payment whereas the first home buyer duty exemption and concession reduces the amount of stamp duty you pay.

The stamp duty exemption for first time home buyers will remain effective until Dec 31 2025. On 8 May 2022 the Government announced that ABSD of 35 will apply on any transfer of residential property into a living trust ie. Stamp duty is charged at 05 on instruments effecting sales of shares.

We give anonymity and confidentiality a first priority when it comes to dealing with clients personal information. However this exemption is available provided certain conditions are fulfilled by the senior citizens. 6 to 30 characters long.

On June 2 the President approved amendments to the Tax Code providing tax benefits to businesses affected by the COVID pandemicAzN 012 bn or 02 percent of GDP. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Countries that regulate access to firearms will typically restrict.

Checks bills of exchange statements of account certificates books of account deeds of transfer of quotas and in some specific cases identified by the Law invoices. The first RM2400 of your annual rental income is entitled for stamp duty exemption. The period agreed upon between the supplier and the buyer shall not exceed forty-five days from the date of acceptance or the day of deemed acceptance.

Approximate date of commencement of proposed sale to the public. Since the concession is calculated on a sliding scale the closer the property value is to 600001 the. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

The amendments grant a one-year exemption from land and property tax to selected sectors including tourism passenger road transportation and cultural facilities. ASCII characters only characters found on a standard US keyboard. Meanwhile the government has proposed a.

We have servers that operate 999 of the time. Effective from April 1 2022 senior citizens aged 75 years and above are exempted from fling ITR. Free of charge on the registration of a limited liability company.

First-home buyers looking at properties valued between 600000 and 750000 also receive a concessional rate of stamp duty. The following are some of the ways we employ to ensure customer confidentiality. The buyer must make payment to the supplier on or before the date agreed upon between him and the supplier in writing or in case of no agreement before the appointed day.

Court of Registration and on submissions to certain authorities eg. As the first RM2400 is exempted from stamp duty the taxable rental amount would be RM12000 RM14400 RM2400. Laws of some countries may afford civilians a right to keep and bear arms and have more liberal gun laws than neighboring jurisdictions.

The economy of Singapore is a highly developed free-market economy with dirigiste characteristics. How much is the first home buyer duty concession worth. The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision.

Stamp Duty Exemption For House Buyers Infographics Propertyguru Com My

Stamp Duty Notes Pptx Bkat3033 A Specialised Taxation Group 10 Stamp Duty No Name 1 2 3 4 Aishah Binti Mat Isa Tay Yih Thern Hwong Boh Course Hero

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Stamp Duty Waived For First Time Purchases Of Houses Costing Rm300 001 Rm1 Mln Iproperty Com My

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

11 Things Every First Time Homebuyer In Malaysia Needs To Know

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Good News For First Time Homebuyers But Not For Investors Says Savills Malaysia The Edge Markets

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Propertyguru Thumbs Up For Property Provisions In Recovery Package

Bcct Link Magazine Issue 4 2018 By The British Chamber Of Commerce Thailand Issuu

Budget 2017 What It Means For Malaysian Property Buyers Owners And Investors Propsocial

Malaysian Wealth Management Latest Developments

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption No 7 Order 2018 P U A 378

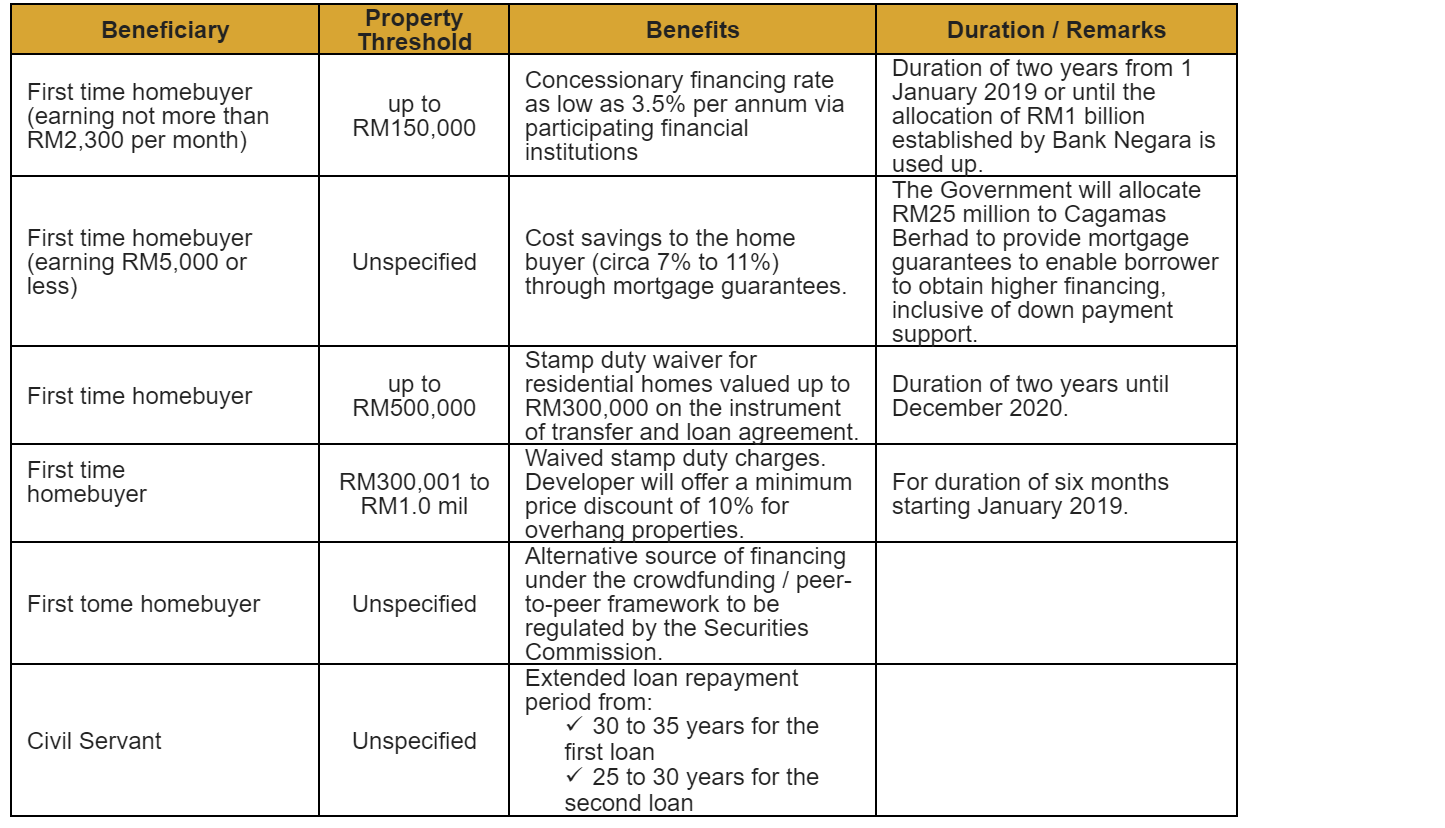

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Vodafone Group Public Ltd Co 2018 Annual Transition Report 20 F

Exemption For Stamp Duty 2020 Malaysia Housing Loan

0 Response to "first time home buyer stamp duty exemption malaysia 2018"

Post a Comment